Welcome to another exciting edition of Neural Notebook! Today, we're diving into the world of sustainable finance with a spotlight on GreenFi, a trailblazing startup that's using AI to transform ESG (Environmental, Social, and Governance) management.

If you're enjoying our content, subscribe today for the latest updates on AI, technology, and the future of product development, delivered straight to your inbox!

🌿 What is GreenFi?

In a world where sustainability is no longer just a buzzword, GreenFi is making waves by leveraging AI to promote sustainable finance. This SaaS-based platform integrates seamlessly with existing systems to aggregate and analyze sustainability data from various sources. Think of it as your eco-friendly financial advisor, but with a digital twist.

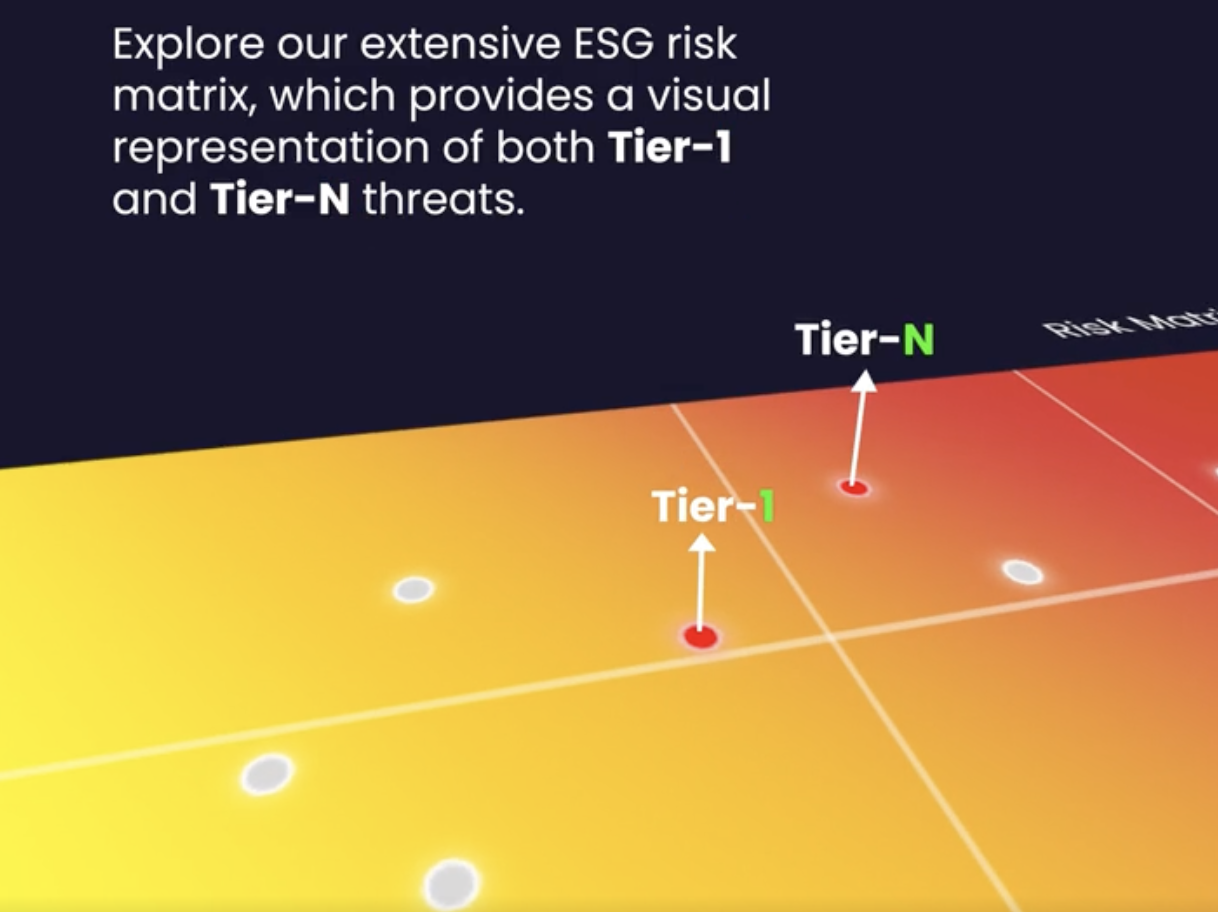

GreenFi's AI-powered engine provides actionable insights and predictive recommendations for ESG-compliant business decisions. This means financial institutions and corporates can now manage ESG risks more effectively, identify potential issues, and set suitable KPIs—all while keeping an eye on real-time data to track trigger conditions and verify events.

But what truly sets GreenFi apart is its AI-powered ESG Knowledge Library, offering vetted information on ESG risks, incidents, signals, and tailored recommendations for various industries. It's like having a sustainability encyclopedia at your fingertips, constantly updated by a global team of ESG analysts.

🪄 AI Magic Behind GreenFi

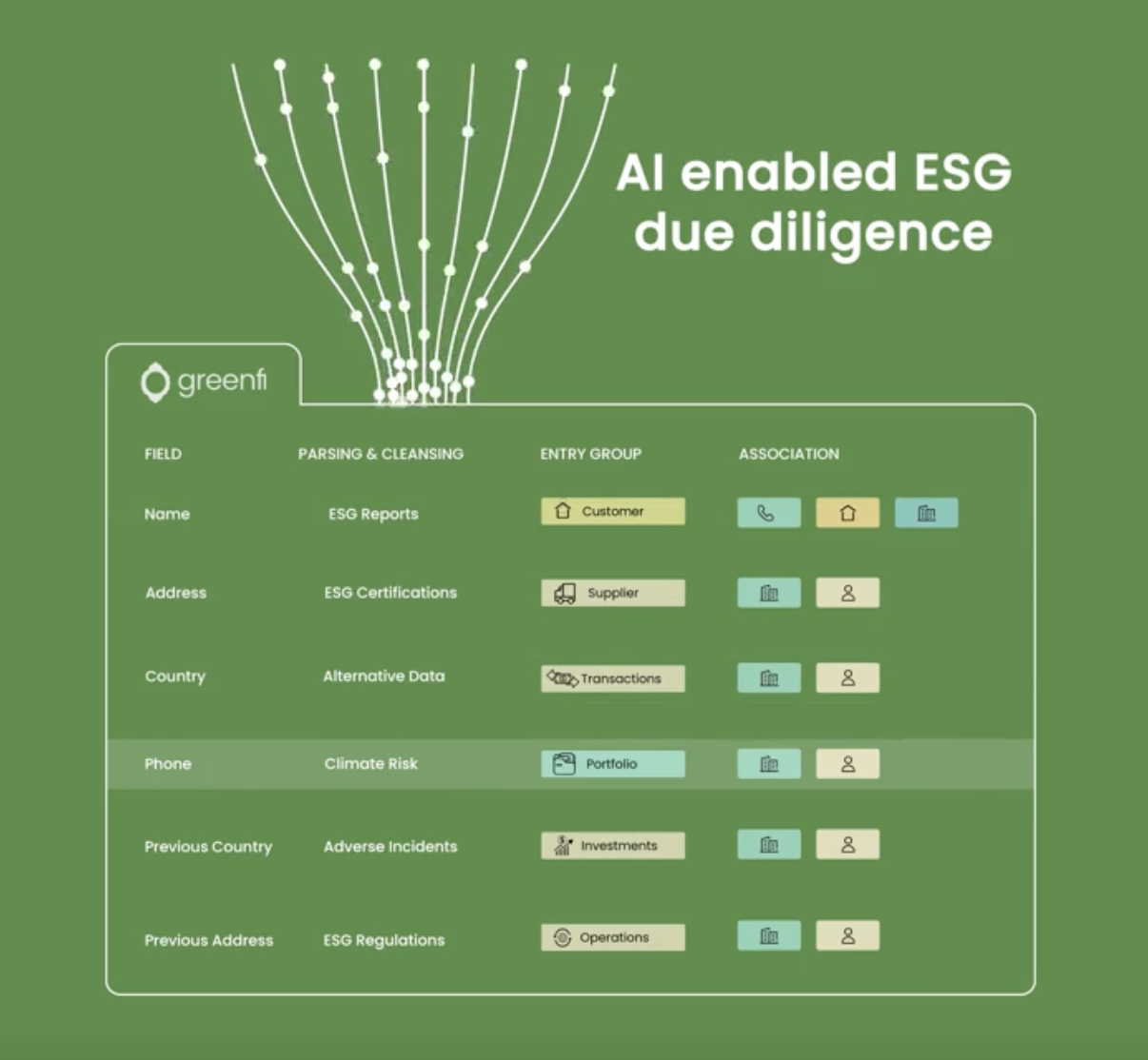

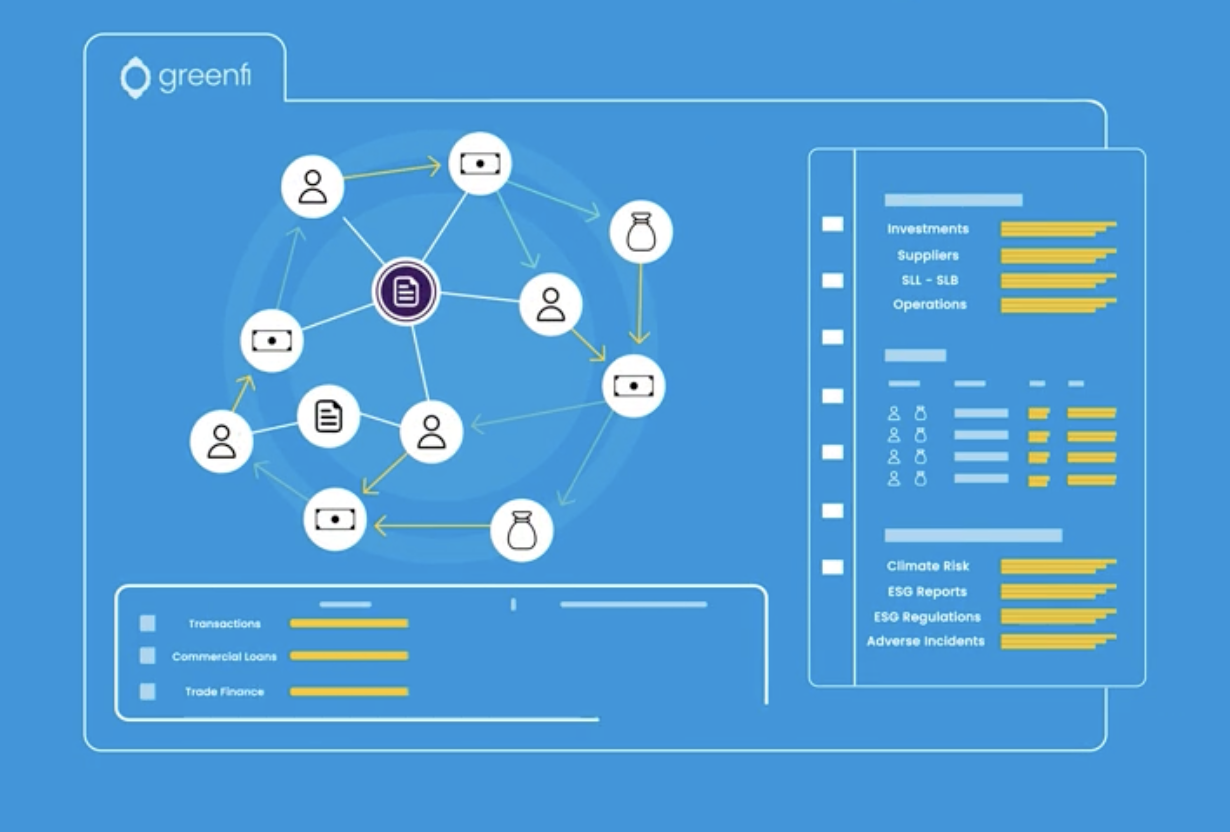

At the heart of GreenFi's platform is a sophisticated AI system that automates data collection and analysis from multiple sources, including disclosures and public data. This isn't just about crunching numbers—it's about providing predictive insights that enhance risk assessment and transparency.

GreenFi employs advanced AI analytics, including ESG AI agents and the world's first ESG Large Language Models (LLMs). These tools automate ESG decision-making using a rich library of risk factors, regulations, and recommendations. It's like having a crystal ball that not only predicts the future but also tells you how to prepare for it.

The platform's open architecture allows for seamless integration with existing systems, making it adaptable to various industries and business needs. This flexibility is crucial in the ever-evolving world of ESG data management.

💪 Stacking Up Against the Competition

In the crowded field of ESG AI software, GreenFi stands out for its comprehensive data aggregation and predictive insights. While not yet listed among the top 10 ESG reporting software platforms, it's recognized for pioneering a new era of sustainable finance in the ASEAN region.

Compared to other ESG software like Sweep, Workiva, Persefoni, and Normative, GreenFi's AI-driven approach offers a unique edge. It provides deterministic decisions rather than probabilities or scores, setting it apart from its competitors.

However, these other platforms may have more global recognition. But with GreenFi's potential for global scaling, it's only a matter of time before it becomes a household name in ESG management.

📚 ESG Knowledge Library: Personal Sustainability Guru

GreenFi's ESG Knowledge Library is a game-changer for businesses looking to streamline their ESG due diligence processes. Utilizing pre-trained Language Models, the library delivers accurate and timely insights on ESG risks, incidents, signals, and tailored recommendations.

The platform is regularly updated by a global team of ESG analysts, ensuring the information remains current and comprehensive. A rigorous vetting process provides industry-specific and role-based ESG knowledge, making the information relevant and actionable for various stakeholders.

Designed for traditional industries like financial services, insurance, food and agriculture, fashion and apparel, retail, real estate, and consumer goods, the library addresses the unique ESG challenges faced by these sectors.

🌎 Real-World Impact: GreenFi in Action

GreenFi's software is already making a significant impact in the financial sector. For instance, it has streamlined ESG reporting and risk management for UOB (United Overseas Bank), improving transparency and accuracy in ESG data collection and analysis.

The platform is used by financial institutions and corporations for ESG due diligence and risk assessment, aiding in identifying and quantifying risks and opportunities associated with sustainable investments, transition, insurance, and supply chain management.

GreenFi's AI platform is also integrated with insurance systems to assess ESG risks, determine trigger thresholds, and price premiums for applicants. It's a versatile tool that's driving sustainability in ASEAN and beyond.

🚀 Sustainable Finance with GreenFi

Looking ahead, GreenFi is poised to play a pivotal role in the transition towards sustainable finance. Its AI-powered platform facilitates the transition of traditional financial institutions by automating ESG risk assessments and providing accurate insights in a timely manner.

GreenFi's software integrates seamlessly with existing systems, enhancing ESG transparency, improving risk management, and supporting regulatory compliance. This contributes to the broader goal of transitioning towards a net-zero and nature-positive economy.

As more businesses adopt GreenFi's platform, we can expect to see a significant shift towards more sustainable business practices and investments.

🤝 Opportunities for Investors and Businesses

For investors and businesses, GreenFi presents a wealth of opportunities. By leveraging its AI-powered platform, companies can unlock new opportunities in sustainable finance, optimize their supply chains, and enhance their ESG reporting capabilities.

GreenFi's platform offers a user-friendly interface and high configurability, making it adaptable to various industries and business needs. It also provides a free trial period to ensure that each customer can fully tailor the platform to meet their specific business requirements.

As the demand for sustainable finance solutions continues to grow, GreenFi is well-positioned to become a leader in the ESG AI software market.

GreenFi is more than just an ESG AI software—it's a catalyst for change in the world of sustainable finance. By providing comprehensive ESG data aggregation, predictive insights, and seamless integration with existing systems, GreenFi is helping businesses navigate the complex landscape of ESG management.

With its AI-powered platform, GreenFi is driving progress towards a more sustainable future, one data point at a time. Whether you're a financial institution, corporate, or investor, GreenFi offers the tools you need to make informed, ESG-compliant decisions.

So, if you're ready to turn green into gold, it's time to explore what GreenFi has to offer.

Cheers,

The Neural Notebook Team

Twitter | Website

P.S. Don't forget to subscribe for more updates on the latest advancements in AI, and how you can start leveraging them in your own projects.